On 17 May 2019, The Stock Exchange of Hong Kong Limited (Exchange) published a consultation paper “Review of the Environmental, Social and Governance Reporting Guide and related Listing Rules”, proposing to strengthen the rules on issuers’ governance and disclosure of environmental, social and governance (ESG) activities and metrics.

At the same time, to reinforce its focus on ESG matters and board diversity (in particular, gender diversity), the Exchange also published:

e-training “ESG Governance and Reporting” and new frequently asked questions (No. 24K and 24L in Series 17 and No. 2A in Series 18); and updated Guidance Letter HKEX-GL86-16 (i) setting out the Exchange’s expected disclosure on ESG matters and (ii) requiring disclosures on board diversity (including gender) in the listing documents of new applicants.

A. Consultation proposals on ESG reporting

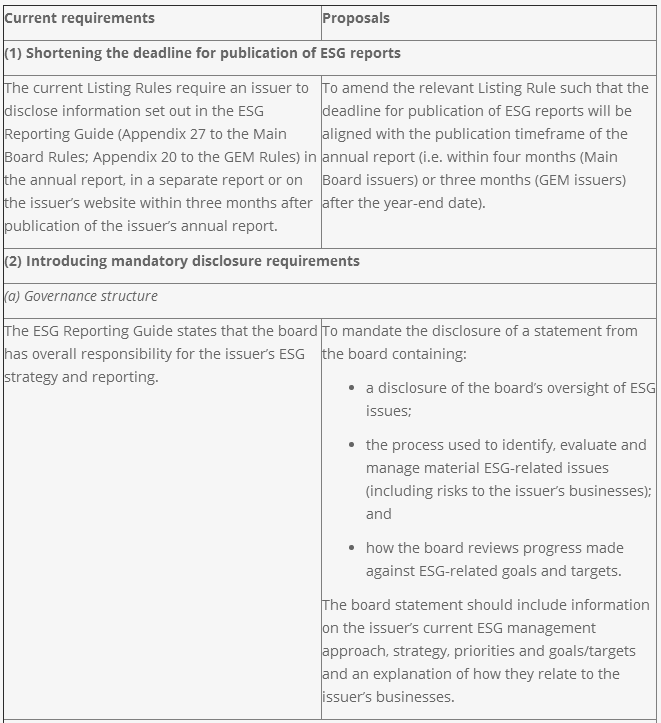

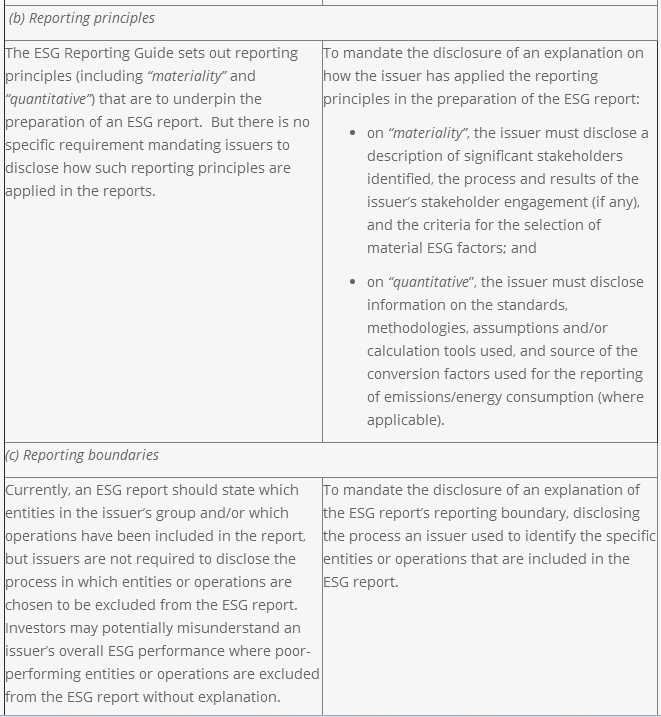

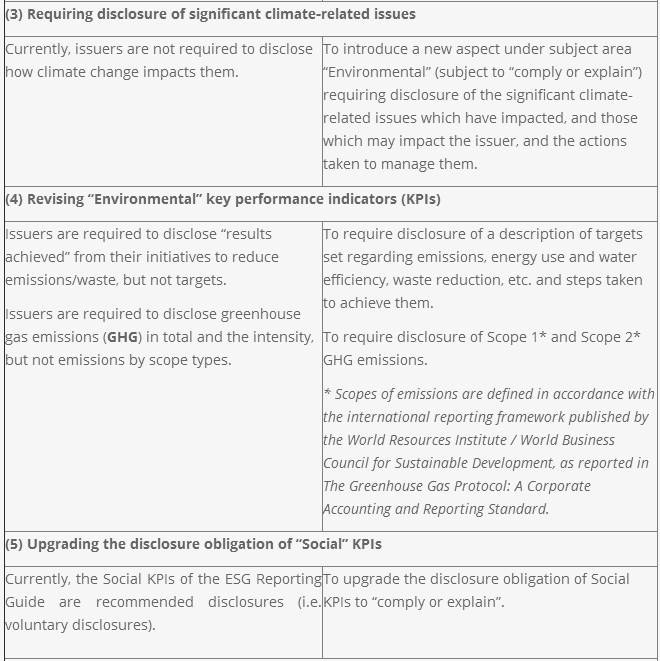

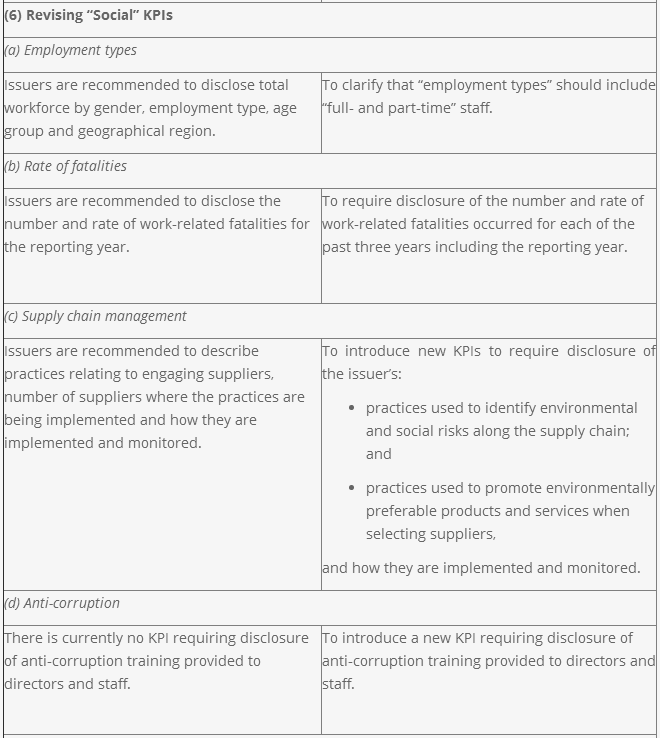

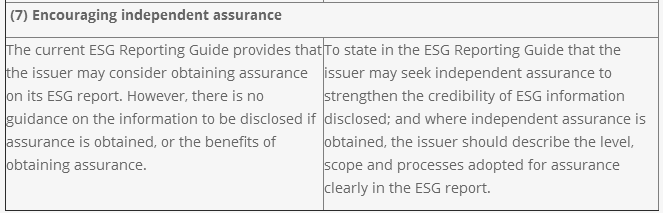

The table below summarises the current requirements and the key proposals in the consultation paper:

The deadline for responding to the consultation is 19 July 2019.

Expected implementation timeline - Subject to responses to the consultation, the Exchange intends to implement the proposals for financial years commencing on or after 1 January 2020, whereupon issuers would need to start gathering the necessary information for the purpose of publishing their ESG reports under the revised ESG Reporting Guide in 2021.

B. Guidance materials on ESG governance and reporting

FAQs No. 24K and 24L in Series 17 and FAQ No. 2A in Series 18 have been added to clarify how different aspects of ESG relate to the Corporate Governance Code (Appendix 14 to the Main Board Rules; Appendix 15 to the GEM Rules).

The key points are summarised below:

Principle C.2 of the Corporate Governance Code requires the board to be responsible for evaluating and determining the nature and extent of the risks it is willing to take in achieving the issuer’s strategic objectives. This principle refers to all material risks in connection with the issuer’s businesses which should include, amongst others, material ESG risks.

For the purpose of Code Provision C.2.2 of the Corporate Governance Code, the Exchange expects the issuer to ensure the adequacy of resources for the issuer’s accounting, internal audit and financial reporting function, as well as those relating to the issuer’s ESG performance and reporting.

Issuers should reflect in their ESG reports their governance structure in ESG matters including the board’s role in the oversight of ESG matters and assessing and managing material environmental and social risk issues.

In addition, the Exchange has also launched an e-training course, “ESG Governance and Reporting”, which explains the board’s leadership role in ESG matters.

C. Additional disclosures in listing documents on ESG matters and board gender diversity

The Exchange has revised Guidance Letter HKEX-GL86-16 to require new applicants to include in their listing documents:

more specific ESG disclosures, including material information on applicants’ environmental policies, and details of the process used to identify, evaluate and manage significant ESG risks; and

a policy on board diversity (including gender). Where an applicant has a single gender board, it should disclose and explain:

(a) how and when gender diversity of the board will be achieved after listing;

(b) what measurable objectives it has set for implementing gender diversity (for example, achieving a specific numerical target for the proportion of the absent gender on its board by a certain year); and

(c) what measures the applicant has adopted to develop a pipeline of potential successors to the board that could ensure gender diversity of the board.

- CBCSD and Members Participated and Suggested on the Project for Technical Regulation on Low-carbon Pilot Community

- CBCSD and Members Participated in the APEC Cooperation Network Construction Forum of Green Supply Chain

- Calculation Method of CO2 Emissions in Petroleum and Natural Gas Exploitation Enterprises & Calculation Method of CO2 Emissions in Water Network of Chemical Enterprises

- CBCSD Attended the Workshop for Environmental Protection and Sustainable Development and Delivered Introductions

- WBCSD: Tackling the Challenge, How to Make Informed Choices on Forest Product?

- The National New-Type Urbanization Plan Released, Board Members of CBCSD Help the Sustainable Development of Cities

- Board members of CBCSD Actively Participated in the Carbon Trading and International Climate Change Process

- Two industrial Standards Compiled by CBCSD Passed Examination

- Widespread Use of the Achievements Businesses Energy Saving and Greenhouse Gas Management

- CBCSD held Chemical industry enterprise value chain (range 3) greenhouse gas emissions, accounting and reporting guidelines