A steady rise in carbon prices in China could attract more investment in the coming years, with the power sector looking for a more significant share in the national carbon market.

By next year, nearly 47 percent of major carbon-emitting industries are likely to make a "strong or moderate" investment decision based on the prevailing carbon price under the Emission Trading Scheme (ETS).

At the end of 2030, the number of enterprises making investment decisions based on carbon prices would swell to 76 percent, said a survey by China Carbon Forum (CCF) released on Monday.

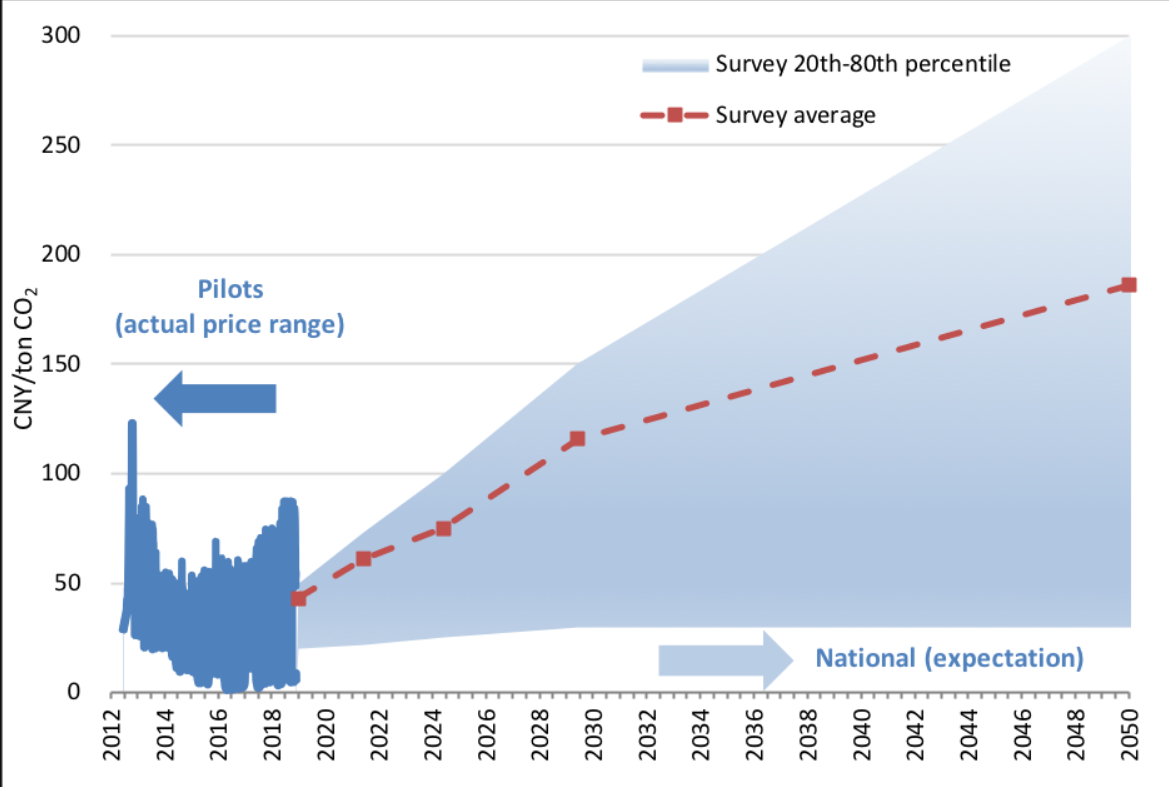

The price per tonne of carbon dioxide emitted is expected to rise from 43 yuan (6.11 U.S. dollars) in 2020 to 116 yuan (16.48 U.S. dollars) by the end of 2030. The rate would further witness an upward spiral to settle at over 180 (25.58 U.S. dollars) per tonne of carbon by 2050.

"As the impacts of climate change are becoming obvious, the world is closely watching large emitters. This survey shows continued confidence in China's national efforts to put a price on carbon," said Dimitri de Boer, co-author of the study.

The survey jointly conducted by the CCF, ICF, and SinoCarbon was based on feedback from a range of sectors, including 63 percent from industry stakeholders.

After running seven pilot ETS in Beijing, Tianjin, Shanghai, Chongqing, Shenzhen, Guangdong, and Hubei, China launched a national level ETS in 2017.

While the pilot scheme covered major polluting sectors, including power, cement, steel, and petrochemicals, the current national ETS focuses only on the power sector. The scheme is likely to be rolled out for other sectors soon.

More than 70 percent of respondents from the power industries feel that their sector would start spot trading by next year.

Cement, ferrous metals and aluminum industries, known for emitting large quantities of carbon dioxide, also said they expected to benefit from higher carbon pricing. Nearly 50 percent of respondents felt that the sector would be prepared to enter the national ETS by 2022.

"The development of the national emissions trading system in China is important for the global fight against climate change and provides opportunities for cooperation with Europe," said Mark Bressers, director of the Dutch Emissions Authority (NEa).

Carbon trading is one of the most crucial areas under negotiation at the global climate summit, with delegates deciding on the format of international collaboration on carbon markets to reduce emissions.

Huw Slater, a research and project manager with CCF, said China's efforts to introduce a nationwide carbon pricing system would boost confidence at the ongoing COP25 in Madrid.

"Delegates would be assured that China is making efforts for the implementation of the Paris Agreement," he told CGTN.

A similar survey last year by CCF expected carbon prices to rise from 51 yuan (7.25 U.S. dollars) in 2020 to 86 yuan (12.22 U.S. dollars) in 2025 for each tonne of carbon dioxide emitted.

- CBCSD and Members Participated and Suggested on the Project for Technical Regulation on Low-carbon Pilot Community

- CBCSD and Members Participated in the APEC Cooperation Network Construction Forum of Green Supply Chain

- Calculation Method of CO2 Emissions in Petroleum and Natural Gas Exploitation Enterprises & Calculation Method of CO2 Emissions in Water Network of Chemical Enterprises

- CBCSD Attended the Workshop for Environmental Protection and Sustainable Development and Delivered Introductions

- WBCSD: Tackling the Challenge, How to Make Informed Choices on Forest Product?

- The National New-Type Urbanization Plan Released, Board Members of CBCSD Help the Sustainable Development of Cities

- Board members of CBCSD Actively Participated in the Carbon Trading and International Climate Change Process

- Two industrial Standards Compiled by CBCSD Passed Examination

- Widespread Use of the Achievements Businesses Energy Saving and Greenhouse Gas Management

- CBCSD held Chemical industry enterprise value chain (range 3) greenhouse gas emissions, accounting and reporting guidelines